Summary:

Opinion trading platforms enable you to turn your expertise into profits by speculating on real-world event results. Guess “Yes” or “No” on everything from sports to politics. These talent-driven platforms provide an interactive means to follow the news and possibly collect returns.

The online world is full of new means of interacting with information, and for an individual, it presents new opportunities for wealth growth. One of the most exciting of these trends is the growth of opinion trading apps. These websites are redefining the way we interact with current events, making everyday knowledge into a real commodity.

In this Blog, we are going to delve into the diverse world of opinion trading, ranging from its underlying principles to the methods that can result in victory.

What are Opinion Trading Apps?

An opinion trading app is an application where users make bets on the outcome of future events. They are not shares or stocks in any company, but rather bets on how probable a certain event is to occur.

It’s like a stock market for events, where your “shares” are your guesses. From the victor of a cricket game to the next political turning point, if you have a well-informed opinion, you can sell on it.

What Led to The Development Of Opinion Trading Platforms

The idea of prediction markets has been around for some time, but the introduction of easy-to-use mobile apps brought it mainstream.

Originally, sites are for scholars, but opinion trading has turned this into a vibrant and mainstream activity that can be practiced by the masses across the world.

Major Distinctions from Traditional Trading Apps

Though both are trading and risky financially, opinion trading and conventional trading apps, such as stocks or forex, have some basic differences:

Underlying Asset: In conventional trading, you deal with financial products like stocks, bonds, or commodities. In opinion trading, you deal with the result of actual events in the real world.

Knowledge Base: Stock trading success is frequently dependent upon detailed financial analysis. Opinion trading, in contrast, may be fueled by a broad base of knowledge, ranging from sports data to political movements.

Simplicity: Opinion trading tends to be based on a basic “Yes/No” proposition, which is easier for beginners to understand.

How does the Opinion Trading App Work?

Opinion trading applications have taken the world by storm, combining educated guesswork with the forces of the market. But what is happening behind the scenes? How does one ordinary opinion on a forthcoming occurrence end up as a marketable commodity? This is a step-by-step explanation of how these new platforms operate.

Core Concept: Trading on Prediction

Fundamentally, opinion trading is a way of pricing knowledge and insight. In conventional stock markets, where you buy and sell a company’s shares, in these markets you buy and sell on the results of actual things happening in the world. Your forecast is the “asset.” If you think something will happen, you “buy” it happening. If you think it won’t happen, you “sell” or go short against it. This converts each big news story, whether in sports, finance, or politics, into a possible trading opportunity.

Yes/No Proposition Mechanism

The most widespread and accessible feature of opinion trading apps is the binary “Yes/No” proposition. All events are presented as questions that have an absolute “Yes” or “No” answer.

Example: “Will India win the next cricket match against Australia?”

The users can then purchase “Yes” shares in case of concurrence with the proposition or “No” shares if they disagree. The value of these shares is usually between ₹0.5 and ₹9.5, which represents the perceived probability of the event by the market. If a “Yes” share is priced at ₹7, then a premium of 70% is thought to be the chance of that particular outcome. The total amount in case of a correct “Yes” and a correct “No” share is always fixed, usually ₹10.

Peer-to-Peer Trading Model

An important aspect of these sites is the peer-to-peer (P2P) model. You aren’t trading against the site or “the house.” Rather, with each buyer of a “Yes” share, there has to be a seller, essentially a buyer of a “No” share. The app is a facilitator, bringing these two together and developing a dynamic market. Such a P2P system guarantees that the price is determined by the overall view of the trading community rather than by a governing body. The site generally generates revenue by taking a small commission on the winnings.

Real-time Market Dynamics and Price Volatility

The value of “Yes” and “No” shares is dynamic. It changes in real-time according to the basic laws of supply and demand, similar to a stock exchange.

Supply and Demand: When more individuals begin purchasing “Yes” shares for an event, its value will increase, and the value of “No” shares will decrease.

Information Flow: Price is strongly affected by new information. For example, in a game of cricket, if Team A’s leading batsman is out, the price for “Yes” on Team A winning will probably decrease since traders are responding to the news.

This immediate change makes active trading possible. A user can purchase a “Yes” share at one price and sell it at another price before the event has even ended, thus securing a profit from changing public opinion. This exercise of setting the price through the combined efforts of sellers and buyers is referred to as price discovery.

Event Pay-Out and Settlement Process

After the event is over and the result is ascertained, the settlement process starts.

Source of Truth: The solution employs a pre-declared, verifiable, and impartial source to arrive at the conclusive result of the event.

Settlement: When the result is “Yes,” all “Yes” shares are settled at the highest (e.g., ₹10), and all “No” shares are worthless (settled at ₹0). For a result of “No,” the “No” shares are settled at ₹10, and the “Yes” shares at ₹0.

Payout: The payout amount is determined from the price at which the user purchased the shares. For instance, if a user purchased 10 “Yes” shares at ₹6 and the result is “Yes,” their investment was ₹60. The settlement value is ₹100 (10 shares × ₹10). Their profit, pre-commission, is ₹40. This is credited to the user’s in-app wallet, which they can then withdraw.

Key Features of Opinion Trading Apps

A successful opinion trading app is something more than a prediction marketplace. It’s an integral platform for a smooth and interactive user experience. For learning about key features of fantasy sports, refer to our guide and grasp the process of fantasy sports construction in detail.

Easy Navigation Interface: A simple and clear interface is important to invite and keep users.

Market Categories: The top apps have various categories of markets such as sports, politics, entertainment, finance, and so on.

Real-Time Data Analytics: Relevant data and analytics access enable users to make well-informed decisions.

Secure Payment Gateways: Convenient and secure deposit and withdrawal facilities are essential.

Engagement Tools: Sharing of trades by users and user interaction with each other boost the experience.

Live News Updates: Offering filtered news and expert commentary provides value to traders.

Trading Features: Features such as deposit limits and self-exclusion capabilities are crucial for encouraging responsible trading.

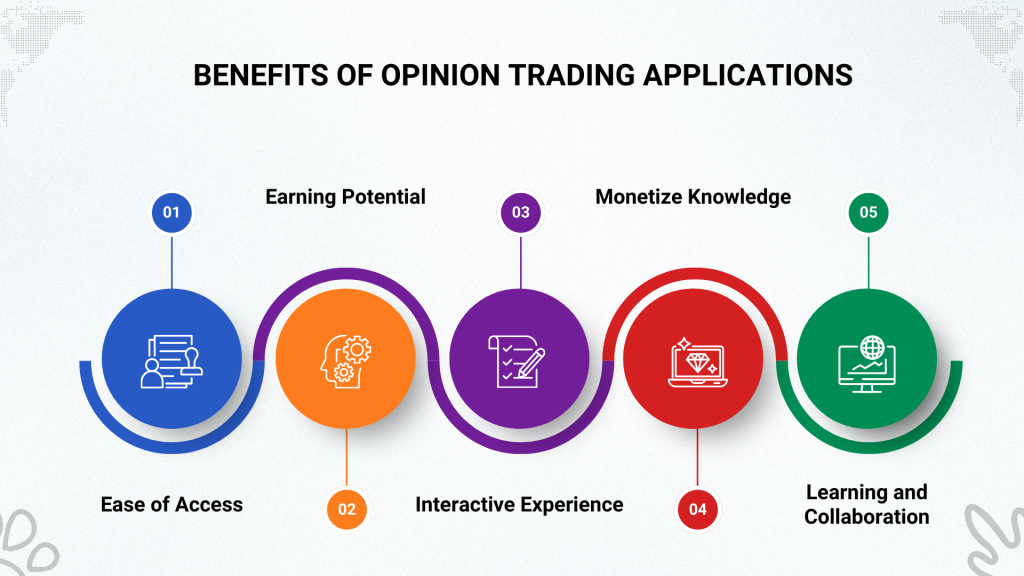

Benefits of Opinion Trading Applications

The increasing popularity of opinion trading apps is driven by a special combination of advantages that appeal to a contemporary audience.

Ease of Access: The easy “Yes/No” format and utilization of common knowledge make it an excellent starting point for beginners in trading.

Earning Potential: Contrary to pure chance games, achievement in opinion trading is directly related to one’s knowledge and skill to critically analyze information.

Interactive Experience: These apps convert passive news viewing into an active and exciting experience.

Monetize Knowledge: People with profound knowledge in particular areas can now turn their expertise into profits.

Learning and Collaboration: The P2P model creates a community where users are able to learn from one another’s buying and selling habits and insights.

Challenges and Risks in Opinion Trading

Even though they have plenty of advantages, it is important to note the difficulties and risks involved with opinion trading.

Legal and Regulatory Uncertainties: The legal framework for opinion trading remains developing in most countries, including India. To learn about legal compliance in the fantasy sports business, check our guide and understand Legal Compliance in Fantasy Sports App Development in detail.

Potential for Manipulation: The fact that it is based on actual events provides the opportunity for misinformation to drive market behaviour.

Platform Credibility: It is the responsibility of the platforms to be transparent, reasonably settle events, and keep user funds secure.

Over-Trading Concerns: The speed of opinion trading has the potential to cause addict-like behaviour if one doesn’t handle it in a disciplined manner.

Popular Opinion Trading Apps in 2025

| Feature | Probo | MPL Opinio | PlayerzPot | Real11 |

|---|---|---|---|---|

| Primary Focus | Broad opinion trading across categories. | Live cricket and sports focus. | Multi-gaming with opinion trading. | Fantasy sports with opinion games. |

| Unique Selling Point | Non-sports: finance, news, entertainment. | MPL gaming ecosystem integration. | Fantasy, casual games, opinion mix. | Innovative opinion game modes. |

| Target Audience | News, finance, general users. | Cricket fans, MPL users. | Fantasy players, casual gamers. | Serious fantasy, new challenge seekers. |

| Key Categories | Cricket, Crypto, Stocks, News, etc. | Cricket, Football, Kabaddi, Crypto. | Cricket, Football, trending sports. | Cricket, 'ProPlay' & 'Skiller'. |

| Trading Mechanism | Real-time P2P, fluctuating prices. | P2P: Normal & Instant Invest. | P2P, quantity/time matching. | Slot-based, fixed fees/winnings. |

| User Experience | News-feed style, easy navigation. | Simple, Yes/No game-like UI. | Integrated in gaming app. | Fantasy app, multiple formats. |

| Emerging Features | News feeds, Probo Academy. | Tiered commission for traders. | Quantity-based trade priority. | 'Skiller' & 'ProPlay' modes. |

1. Probo

Probo has become a leader in the Indian opinion trade market by providing the widest variety of categories. It effectively achieves the goal of being a “stock market for everything” since people can not only trade based on sports but on financial markets (crypto, stock indices), entertainment (movie box office, YouTube views), political results, and overall news events.

Key Features and Selling Points:

Unparalleled Variety: Probo’s greatest asset lies in its extensive range of subjects. This widest possible appeal encompasses a larger audience than sports fans alone, appealing to those interested in financial news, current events, and popular culture.

Informative Interface: The app is meant to be similar to an interactive news feed. Events are displayed with contextual details, historical facts, and corresponding stats, enabling users to make better-informed decisions right within the app.

Advanced Trading Features: Probo offers key features such as “Stop Loss” to reduce losses and “Book Profit” to lock in gains before an event’s end, providing a sense of strategic richness akin to classical trading platforms.

2. MPL Opinio

Building on the gigantic user base of its parent platform, Mobile Premier League (MPL), Opinio has established a big niche by going all out for cricket. It provides a streamlined and quick trading experience, ideally suited for live match situations.

Key Features and Selling Points:

Cricket-Focused Universe: MPL Opinio thrives during live cricket matches, providing an abundance of questions from the match winner to the number of runs scored in an over. The live nature of such events proves to be a highly immersive experience.

Simplified Entry Points: The “Instant Invest” option makes it easy for new entrants to join without having to be aware of the intricacies of establishing a trade price. They may just tick “Yes” or “No” and invest at the prevailing market rate, which is very convenient.

Seamless Integration: Being within the MPL universe ensures the user has one wallet and an intuitive interface, which has been a huge driver of its adoption by the millions of current MPL players.

3. PlayerzPot

PlayerzPot is a household name in the fantasy sports segment that has been able to successfully incorporate opinion trading into its larger offering. This enables customers to transition easily between fantasy contest playing, casual gameplay, and opinion trading, all under one application.

Key Features and Selling Points:

Single Gaming Experience: Both fantasy sports and opinion trading users are treated to the convenience of a single platform by PlayerzPot. This intermingling of user interests is central to its strategy.

Core Sport Concentration: Although it lacks the extensive category list of Probo, it still has a high concentration on mainstream sports such as cricket and football, the pillars of its fantasy community.

Trade Matching System: PlayerzPot boasts a clear trade matching algorithm that ranks orders based on both the number of shares and the timing of submission, in order to ensure an equitable trading experience for everyone.

4. Real11

Real11, the other established brand from the fantasy sports space, has also pioneered a different innovative approach in opinion-based gaming. Rather than the standard “Yes/No” type, it provides several game modes for a user to assess his/her predicting abilities with variations.

Key Features and Selling Points:

Varied Opinion Types: Real11 is differentiated by its special game types:

- ProPlay: An objective-style quiz in which the users respond to multiple-choice questions about a match with a locked-in entry price and fixed winnings.

- Skiller: A type in which users guess whether a specific statistic (such as a team’s final score) will be “Over” or “Under” a given value.

High-Reward Model: As opposed to the volatile P2P price model, most of Real11’s opinion games utilize a slot-based model. The user pays a set entry fee to predict an answer to a question, and accurate predictions return a portion of the prize pool, which may be a simpler model for certain players.

Building an Opinion Trading App

The process of creating a strong and successful opinion trading app takes a number of important stages and considerations into account.

Market Research: Identifying the target market and formulating a unique value proposition is the starting point.

Functionality Planning: Figuring out the main features, like the trading engine, wallet, and user profiles.

Technology Stack: Selecting proper technologies is important for performance and scalability. Popular choices are React Native for the front end, Node.js for the back end, and possibly blockchain for added transparency.

Security Features: Having strong security features, such as encryption and smart contract audits, is a non-negotiable.

Cloud Infrastructure: The platform should be capable of supporting high volumes of simultaneous users and transactions.

Legal and Regulatory Standards: Complying with the legal and regulatory standards of the target market is essential.

UI UX Design and Testing: A user-friendly and seamless user experience is crucial to user adoption and retention.

Monetization Models: Popular monetization models include charging a small fee on winning trades, subscription for premium features, and in-app ads.

Web3 and Blockchain in Opinion Trading

The merging of Web3 and blockchain technology is set to transform the opinion trading game.

Benefits of Decentralized Platforms: Decentralization has the potential to bring about increased transparency, censorship resistance, and control of funds by users.

Blockchain for Transparency and Trust: Each transaction can be stored on a permanent public ledger, increasing trust and auditability.

Cryptocurrency Integration for Trading: The use of cryptocurrencies for trading can facilitate cheaper and faster cross-border payments.

Smart Contracts for Settlement Automation: Smart contracts can automate the settlement and payout of the event, ensuring fairness without the requirement of a centralized intermediary.

Examples of Web3 Opinion Trading Platforms: Web3 platforms such as PolyMarket are leading the charge with this new phenomenon, showcasing the strength of decentralized prediction markets at the international level.

Legal and Regulatory Environment

The legal standing of opinion trading is one that is constantly being discussed and evolving throughout the world.

Opinion Trading Rules in India: In India, the legality of opinion trading has traditionally been argued in the context of whether it is a “game of skill” or a “game of chance.” Although a number of court decisions have reasoned in favor of the “game of skill” for fantasy sports, the regulation of opinion trading remains in its formative stages.

SEBI Position on Opinion Trading Platforms: The Securities and Exchange Board of India (SEBI) clarified that opinion trading does not come within its regulatory scope as the underlying assets are not securities. This leaves the sector in a bit of a gray area, which is usually regulated by state-level gaming laws.

Global Regulatory Views: The regulatory strategy is very different around the world. Some countries have welcomed and regulated prediction markets, whereas others have been hesitant.

Compliance Issues for Developers: The changing and sometimes uncertain regulatory environment is a major issue for developers and platform operators.

Future of Regulation in Opinion Trading: With the growth of the industry, there is a possibility of more specific and clear regulation being implemented that may bring more stability and legitimacy to the industry. To learn about the legal laws in India regarding online fantasy sports, check our blog to get detailed insight.

Strategies for Opinion Trading Success

Although opinion trading is available, sustained success demands a strategy.

Study and Keep Yourself Up to Date: The more you understand about the events on which you are trading, the better your forecasts will be.

Spread Out Forecasts Over Events: Do not invest all your funds in a single event. Spreading out your trades can assist with managing risk.

Make Use of Platform Tools and Analytics: Leverage the data and analysis tools available on the platform to make better-informed decisions.

Begin Small and Scale Up: As a beginner, begin small to get familiar with the dynamics before investing significant amounts.

Monitor Predictions and Learn from Results: Record your trades and examine both your losses and your wins to spot patterns and make your strategy better.

Shun Impulsive Trading Choices: Emotional trading and impulsive trading are a recipe for disaster. Stay to your research and strategy.

Upcoming Trends in Opinion Trading Apps

The opinion trading world keeps developing, with some very promising trends in the pipeline.

Use of AI and Machine Learning: AI can be utilized to offer users more advanced data analysis as well as custom trading tips.

Development of Market Categories: We should anticipate an even broader variety of tradable events, with additional niche and regional categories.

Gamification and Increased User Interaction: Sites will keep pushing boundaries with new features to enhance the trading process more interactively and rewardingly.

Expansion of Decentralized Platforms: Blockchain technology adoption will see the rise of a new generation of open, user-friendly opinion trading platforms.

Greater Emphasis on User Education: Platforms will devote more resources to educating users on proper trading and winning strategies as the user base expands.

Partnerships with News and Data Providers: Partnerships with credible news and data providers will improve the quality and reliability of information presented to traders.

Build An MPL Opinio Like App with a Fantasy App Developer

Fantasy App Developer is the best company to create opinion trading platforms such as MPL Opinio or Probo. Leveraging their knowledge in real-time data, secure wallets, and high-volume user management, they can reuse existing infrastructure to provide clients with engaging revenue-generating apps.

Their insider perspective on user behaviour within prediction-based ecosystems provides them with a unique advantage in making high-performance opinion trading solutions.

Conclusion

Opinion trading apps are a paradigm shift in how we experience the world around us. They provide a special combination of entertainment, skill-based financial opportunity, and a new means of processing and acting on information. Their potential to democratize trading and create more informed and activated citizens is vast.

As with any financial-risk-involving activity, the necessity of responsible trading cannot be too strongly emphasized. It is important for users to engage with such platforms, keeping in view the risks, and to trade just within their means, with a proper utilization of the responsible trading functionality that these platforms offer.

Frequently Asked Questions

The key distinction is that you are trading a different underlying asset. In share trading, you purchase or sell shares, which are a proportion of ownership in a publicly traded company. Your gain or loss will be based on the performance of the company, the sentiment in the market, and general economic indicators. In opinion trading, you’re not trading a company’s shares but are speculating on the result of an actual-world occurrence. It’s a straight trade on a “Yes” or “No” statement, and your success hinges solely on the validity of your forecast on that particular event.

Opinion trading in India has a legal gray area. To date, 2025, it is not specifically regulated by a governing body such as the Securities and Exchange Board of India (SEBI), which has stated explicitly that such platforms are beyond its regulation since they don’t deal in securities.

The legal controversy centers on whether it is a “game of skill” (usually allowed) or a “game of chance” (similar to gambling, which is prohibited in most states). Although platforms claim they are skill-based, some states have prosecuted them under state gambling laws. Thus, users need to be informed about the changing regulatory environment and possible risks.

The majority of opinion trading apps are peer-to-peer based and make money mainly by charging a commission or platform fee. They will normally levy a minimal percentage (e.g., 10-20%) on the user’s wins. It is their source of revenue for arranging the trade between users who buy the opposing sides of a question. These platforms might also venture into other sources of revenue, such as featured event promotions, data analytics subscription, or in-app advertising.

No, one of the most defining aspects of the binary “Yes/No” system operated by the majority of opinion trading apps is confined risk. Your likely loss is strictly limited to the sum you put down on a specific trade. For example, if you purchase 10 shares in a “Yes” result at ₹7 per share for ₹70 total, the total maximum you can lose is that ₹70. In contrast to some sophisticated financial derivatives wherein the losses can be more than the initial investment, here your loss is always predetermined.

The most important thing for a beginner to do is to begin small and remain knowledgeable. Take time to study the event in-depth before entering a trade. Utilize the data, news streams, and analytics that are available in the app. Begin trading with a low sum of money you can afford to lose to grasp the dynamics of the platform, as well as price changes. Monitor your forecasts, conclude both your successes and failures, and most importantly, keep from making impulsive, emotional choices. A researched, disciplined approach is much more maintainable than going with gut instincts.